Insurance for your fatbike

Insuring a fatbike has always been possible through Phatfourbut it is now also available again through providers such as Centraal Beheer en Interpolis/Rabobank. This is great news for fatbike owners, especially after last year’s concerns when several insurers announced they would stop offering fatbike insurance due to high theft rates, particularly in urban areas like Amsterdam.

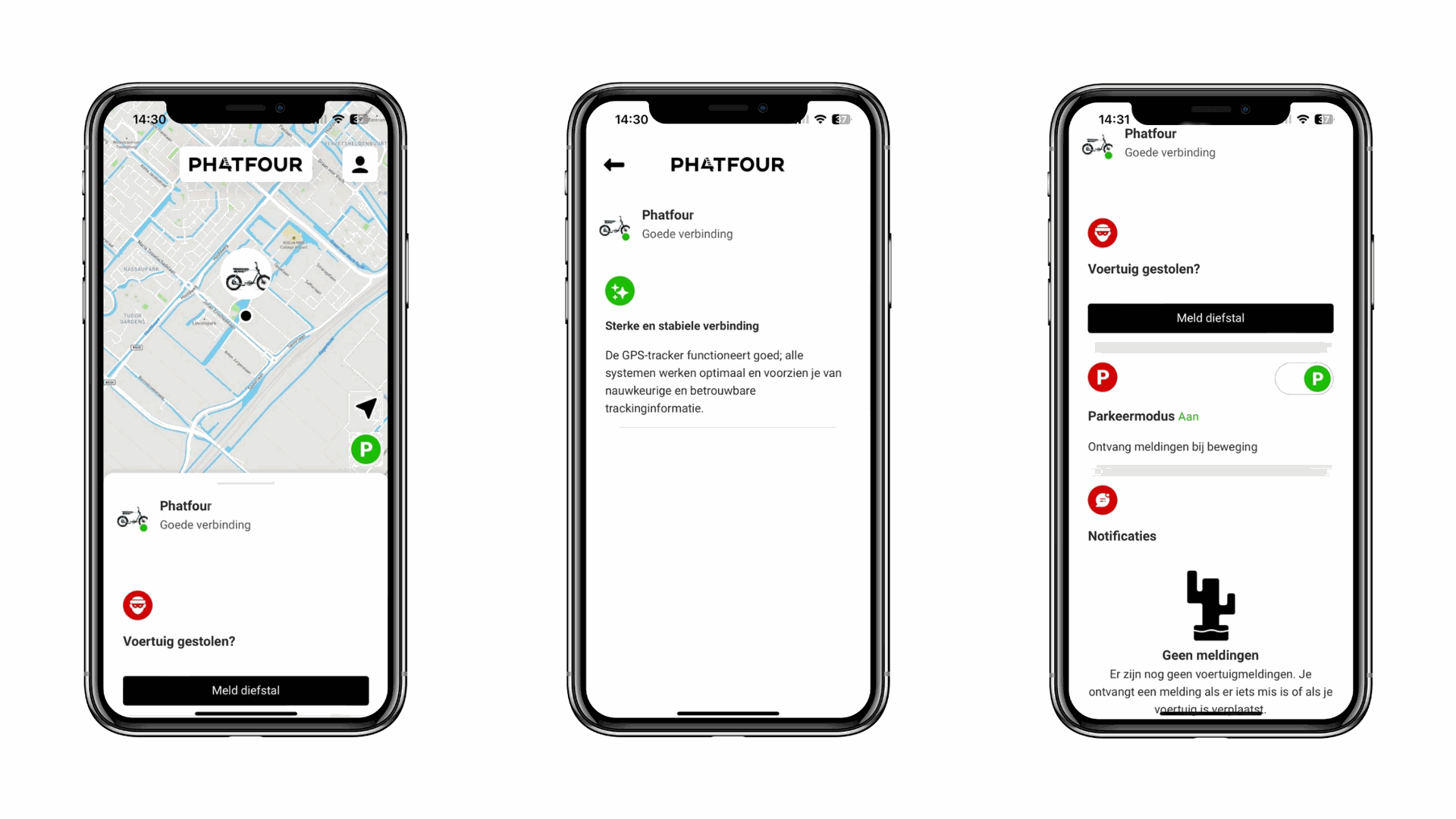

Phatfour Connected makes fat bikes insurable again

With a Phatfour Connected you can take out insurance for your fat bike again. Phatfour Connected is a new anti-theft service.With a tracker, your Phatfour can always be located via an app. An innovation within the segment is that the engine can be turned off remotely in the event of theft. Then the Netherlands' largest security firm, G4S, takes action to recover the stolen bike. Even if the thief manages to remove the tracker, the e-bike remains unusable.

Phatfour's anti-theft service is now available for FLX(+) and FLS+ en FLB+ models.

This solution made Phatfour the first fat bike brand to be insured against theft again since February 1, 2024. The insurance can be taken out from an affiliated Phatfour dealer when purchasing a new Phatfour or from Phatfour itself when ordering on the website.

Fatbike insurance costs

To insure your fat bike it is mandatory to have an activated tracker and Phatfour Connected abonnement to have.The recommended retail price of Phatfour Connected is €89, including VAT & installation. For a subscription you can choose from 1 year, 2 years or 3 years for connectivity including bike recovery service.

The subscription prices are as follows:

1 year: €100, including VAT.

2 years: € 170,- including VAT.

3 years: €220, including VAT.

How much does fatbike insurance cost?

The height of the verzekeringspremie is determined by the purchase price or appraised value of the electric bicycle and the zip code of your place of residence.For new bicycles, you specify the new value for the insurance. For previously purchased bicycles, the dealer must first carry out a valuation (note – this may involve charges).

With a fat bike insurance all risk, the following components are covered by the insurance:

- Theft: theft of the bicycle and parts are fully covered.

- Damage: consequential damage following theft or damage due to vandalism is fully covered.

- Other: in addition to damage and theft, the following components are covered: legal assistance & accident insurance for passengers.

Do you need to insure a fatbike?

In the Netherlands it is not mandatory to take out insurance for a fat bike. Even if there is no legal obligation, it is useful to still insure your fat bike, especially if it is an expensive model or if you plan to ride a lot in crowded places where the risk of accident or theft is higher.

Read here how you can reduce the risk of fatbike theft.

Update: 3 december 2024